If you receive an audit letter from the IRS or State Department of Revenue on your 2022 TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited business returns filed with TurboTax for the current 2022 tax year.

#Turbotax 1040x amendment free#

(TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid.

We will not represent you before the IRS or state tax authority or provide legal advice. Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2022 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited individual returns filed with TurboTax for the current 2022 tax year and, for individual, non-business returns, for the past two tax years (2021, 2020).(TurboTax Online Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state purchase price paid.This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.Whichever way you choose, get your maximum refund guaranteed. Just answer simple questions, and we’ll guide you through filing your taxes with confidence. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.įile your own taxes with confidence using TurboTax.

#Turbotax 1040x amendment full#

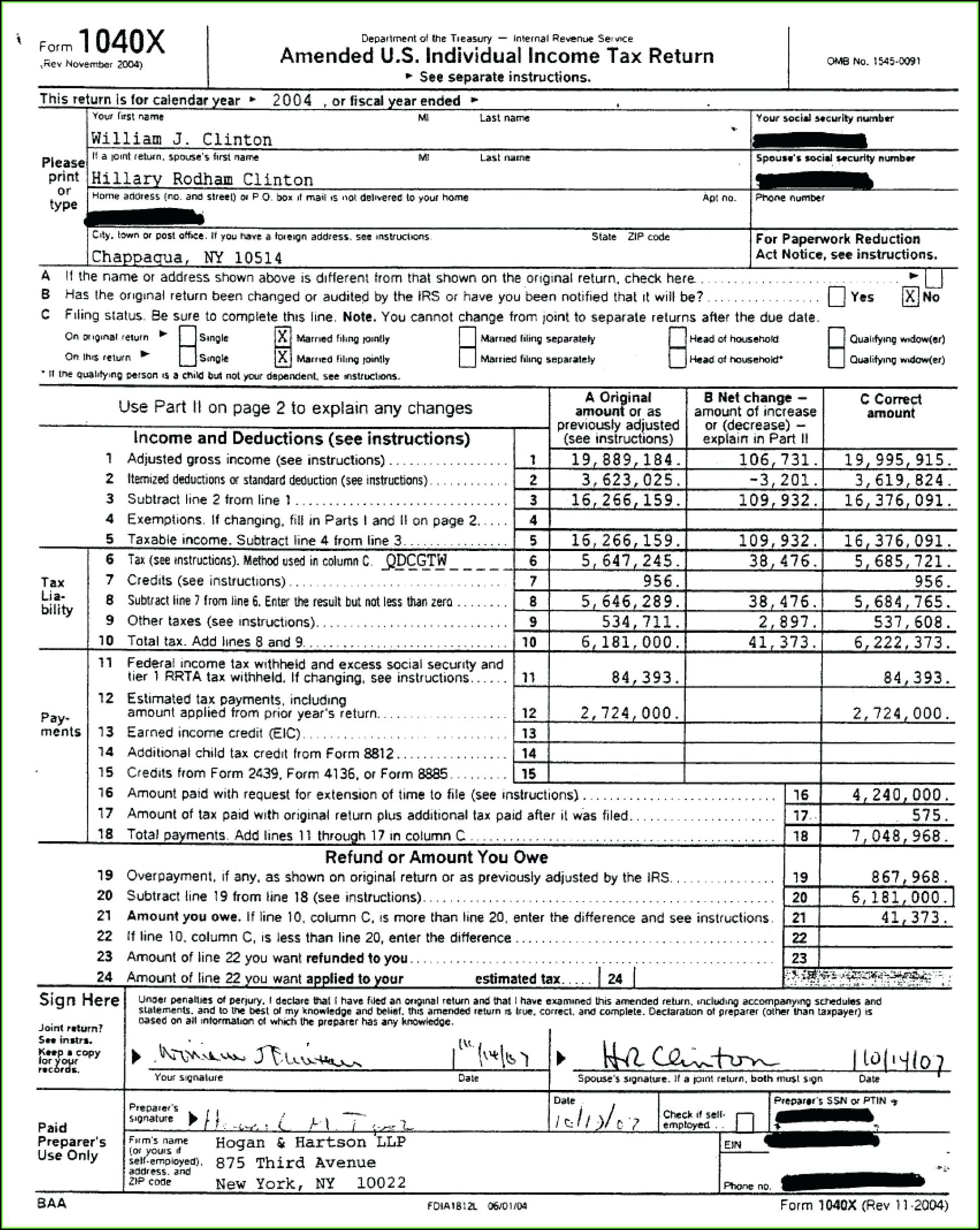

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. The Hawaii form, for example, is Schedule AMD.ĭon't forget to attach a copy of your amended federal return (Form 1040-X) to your amended state return, if the state requires it, as is usually the case. Some states allow you to e-file amended returns while others require that you file a paper return.įor example, California uses Schedule X. Many states also use the X suffix for the form number. Like the IRS, states typically use a special form for an amended return. Second, get the proper form from your state and use the information from Form 1040-X to help you fill it out.First, fill out an amended federal income tax return, Form 1040-X.

You can amend your state tax return in two simple steps:

0 kommentar(er)

0 kommentar(er)